2023 BC Property Assessments Are Here

While some experts are skeptical of BC's 2023 assessment prices. The official Jan 3rd press release has this to say:

'"Despite the real estate market peaking last spring and showing signs of cooling down by summer, homes were still selling notably higher around July 1, 2022 compared to the previous year," says BC Assessment Assessor Bryan Murao. "For both single family homes and condos in Greater Vancouver, most homeowners can expect about a 9% rise in values whereas the Fraser Valley will be a bit higher at about 10% for houses and 15% for condos and townhomes."

“Similarly, the majority of the commercial and industrial properties across the province will also be receiving higher assessed values in the range of 5% to 20% with the Fraser Valley generally higher," adds Murao.

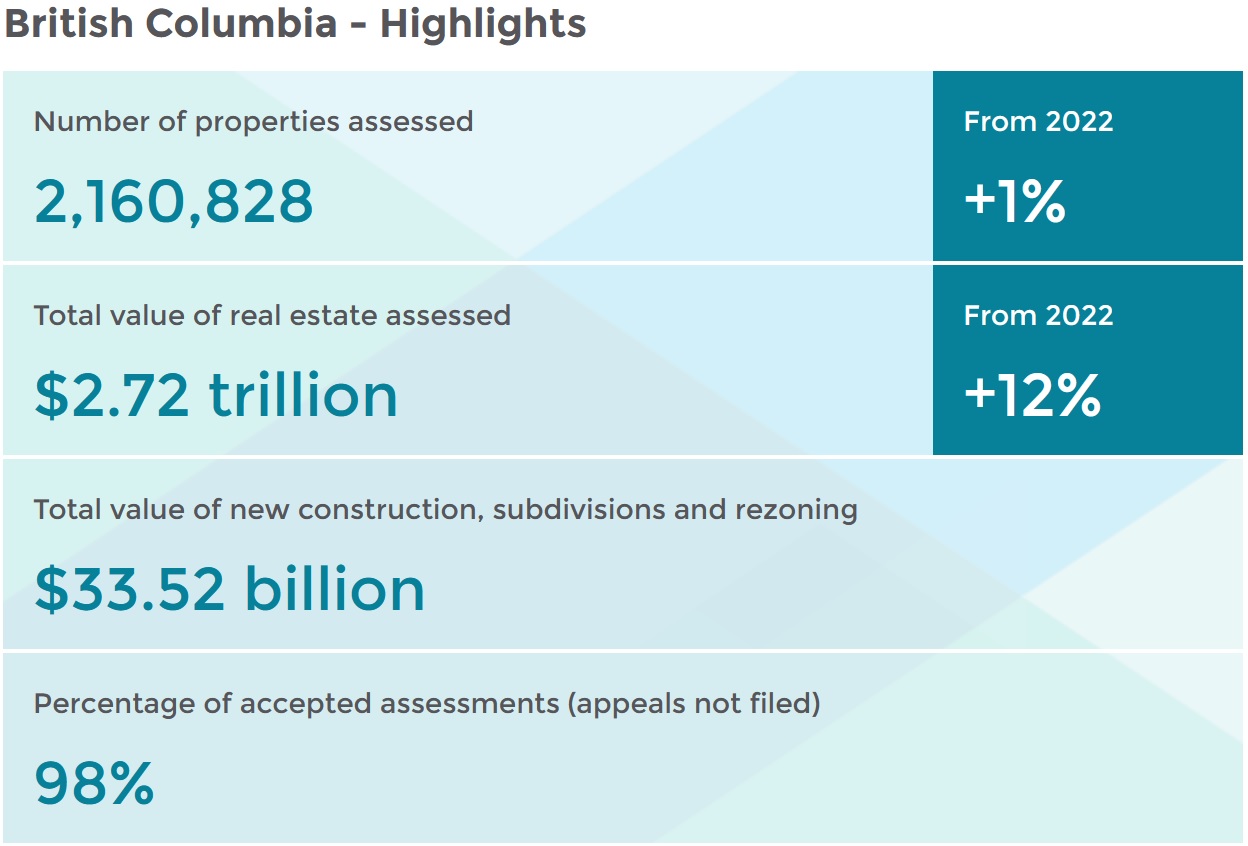

As B.C.'s trusted provider of property assessment information, BC Assessment collects, monitors and analyzes property data throughout the year.

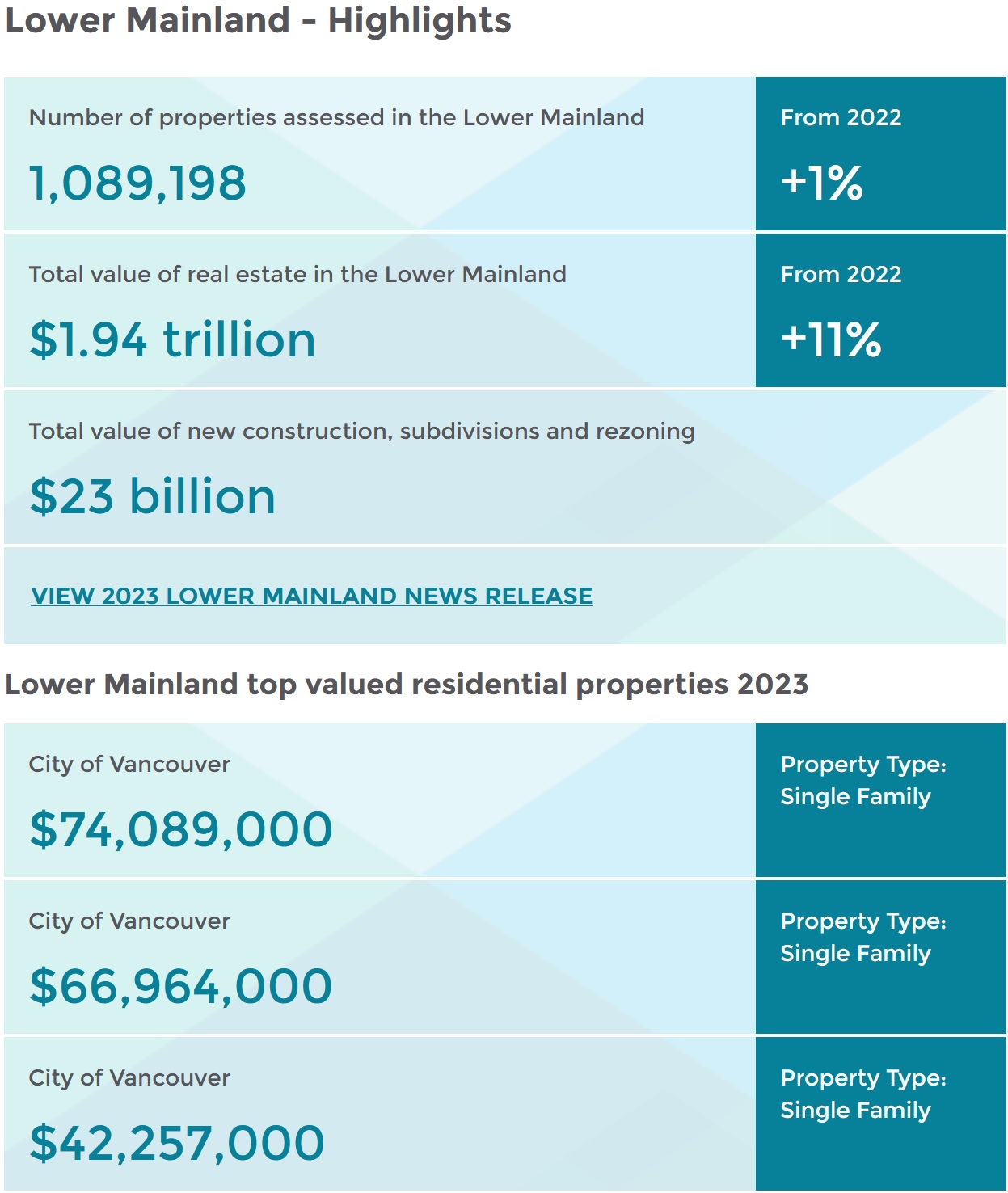

For the Lower Mainland region, the overall total assessments have increased from about $1.75 trillion in 2022 to over $1.94 trillion this year. Almost $23 billion of the region's updated assessments is from new construction, subdivisions and the rezoning of properties. BC Assessment's Lower Mainland region includes all of Greater Vancouver, the Fraser Valley as well as the Sea to Sky area and the Sunshine Coast.'

According to BC Assessment the City of Vancouver saw an average increase of 7% between 2022 and 2023 assessments for detached homes. The Tri Cities on the other hand all saw larger increases with Coquitlam and Port Moody both seeing an average increase of 10% and Poco coming in at 9%. For attached homes Vancouver saw a 6% while the Tri City area saw a much larger 13% increase.

For a full area-by-area assessment breadown CLICK HERE

Highlights for the Lower Mainland Property Region which includes all of Greater Vancouver, the Fraser Valley as well as the Sea to Sky area and Sunshine Coast are as follows:

Following the release of this years assessment some experts were skeptical. City News had this to say:

‘One expert in Vancouver says that many people may see higher property assessment values, due to a change in interest rates.

“For many people, their assessment may be significantly higher than the previous year. For many, it’ll be pretty similar, but very likely your assessment is greater than the current value of your home,” said Tom Davidoff, associate professor at the University of British Columbia’s Sauder School of Business.

Assessor Bryan Murao says most B.C. homeowners can expect about a five to 15 per cent rise in their assessed values.

But the authority warns it may not be an accurate reflection of what homes are actually worth today, as the numbers are based on values from last Jul. 1, before the Bank of Canada started raising interest rates to curb inflation.

“The assessment is based on values last July, when interest rates were still quite a bit lower than they are today,” Davidoff explained.

Some homeowners may also see an increase in taxes with the jump in value, but Davidoff says it depends on where you live.

“Now as for your tax bill, what matters is, ‘what is your property value relative to the average in the city or municipality in which you live?’ And so if everybody’s assessment is 10 per cent too high, your tax bill isn’t really affected,” he said.

But Davidoff adds that the assessment isn’t a perfect system, as it can be tricky to know the market value of a property.

“I mean, it would be nice if you could every day see a fair market value for your home, but it’s hard to know the value of your home until it sells on the market and you get an approximation from last July. That’s what we work on with taxes,” he said.’

For more from City News CLICK HERE

Curious what you homes actual market value is? Reach out a schedule a FREE evaluation today: CONTACT HERE