It's true...in just two days the Bank of Canada will be making another interest rate announcement. And this time economists are not entirely sure what to expect.

Over the course of 2022 skyrocketing, historically high, inflation rates affected every corner of the global economy. While the consequences could/can be felt throughout the breadth of Canada the real estate market in BC took a sizable hit because home prices had spiked so significantly the year previously.

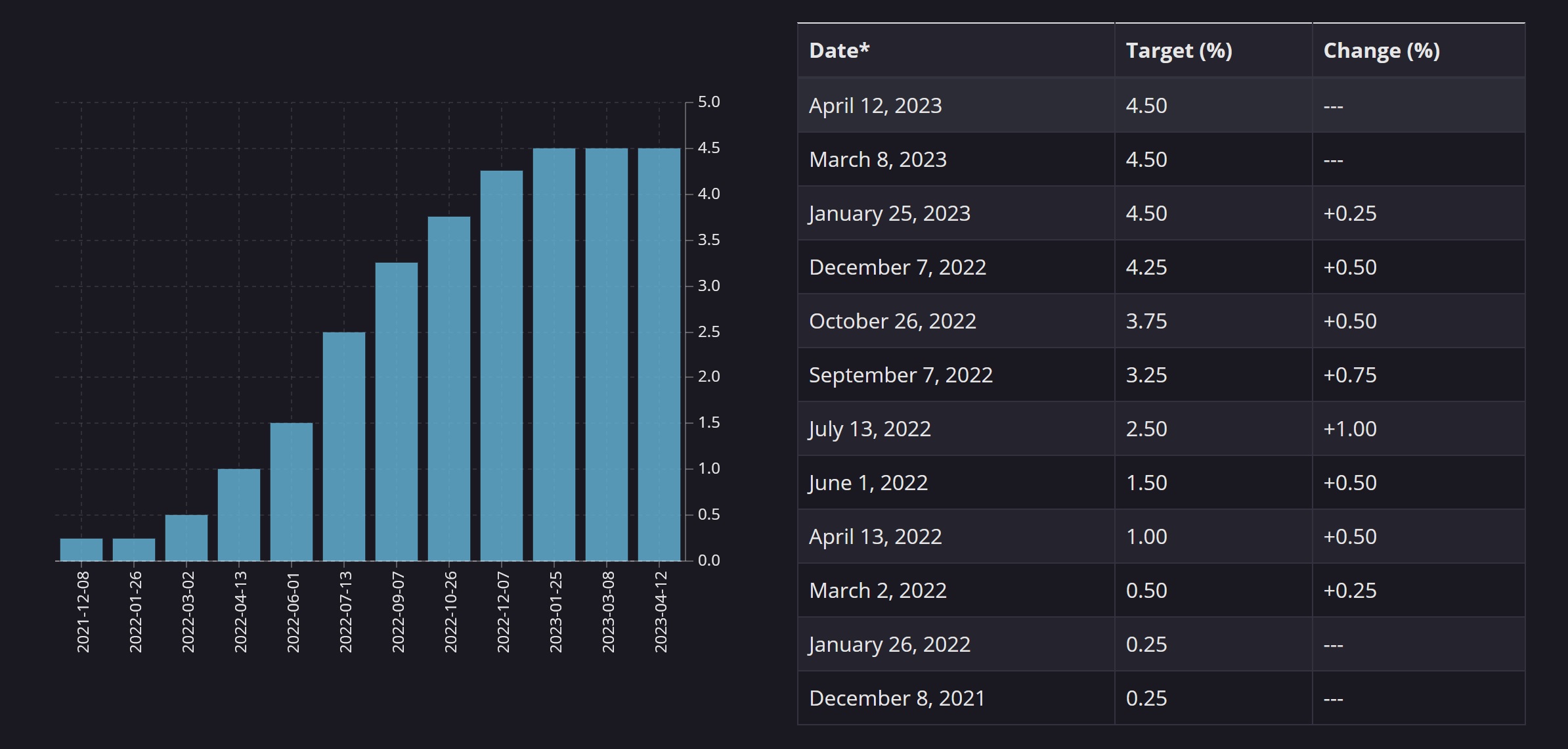

With record inflation rates came endless mortgage rate hikes, greater building costs, increased rental rates, and the rising value of assets as a direct result of supply. Between March 2nd 2022 and January 25th 2023 there were 8 interest rate increases by the Bank of Canada for a total increase of 4.25 points. Since then there has been two interest rate announcements by the Bank of Canada: March 8th & April 12th. Neither announcement resulted in an interest rate increase.

While inflation has not yet receded to an ‘acceptable’ level, by the end of March there were signs of hope. After three months of 2023 economists felt comfortable announcing that recent trends had provided a sign of hope. In the British Columbia Real Estate Association's March review they outlined BC's trajectory and why they believed the worst may be behind us: read more about that here.

Information & charts from the Bank of Canada

However, with a new announcement on the horizon for June 7th...economists are not as certain what the Bank of Canada will have in store for the public.

The Daily Hive talked with Ratehub.ca co-CEO and president of CanWise mortgage lender James Laird and reported the following:

“The Bank had previously indicated that they would hold the key overnight rate as long as things unfold the way they expected. Since their last announcement, two things have happened that don’t align with their expectations,” he told us in an email. “April inflation and Q1 economic growth, including consumer spending, came in higher than forecasted.”

...Laird believes a rate increase is possible next week but unlikely. He says the bank will probably wait for future data to observe whether inflation and economic growth realign with their expectations before it hesitates to hike the rate again.

How will this affect your mortgage?

“Because a rate hike is now a possibility, fixed rates have already increased. Variable-rate holders who thought that rate hikes were over will be holding their breath to see if their rates are going to go up even further,” noted Laird.

“If the Bank does choose to raise rates further, this will put downward pressure on home values and housing activity as spring turns to summer.”

Read the full Daily Hive article here

CBC focuses in on the notion that the interest rate announcement may be an increase because Canada's economy grew by more than expected in first quarter, which in turn increases the odds of an impending rate hike. CBC reported the following:

The latest data shows growth beat out the federal agency's own forecast of 2.5 per cent for the quarter. A preliminary estimate suggests the economy grew by 0.2 per cent in April, after remaining flat in March.

The ongoing resilience in the economy will likely spur discussions of a potential rate hike, as the Bank of Canada is expected to make its next interest rate announcement next week.

The relatively strong GDP showing had investors increasing the odds of a rate hike when the central bank meets next week. Prior to the GDP numbers, trading in investments known as swaps was implying a litle over a one-in-four chance of a hike.

Now, those odds are better than one-in-three.

Statscan says growth in exports and household spending helped spur growth in the first quarter. On the other side of the ledger, slower inventory accumulations as well as declines in household investment and business investment in machinery and equipment weighed on growth.

Tuan Nguyen, an economist with consulting firm RSM Canada, says the GDP numbers "blew past expectations."

Regardless of what happens June 7th is only a handful of days away...

If you have questions about how interest rates may affect the value of your home reach out today. We would be more than happy to help.

CLICK HERE to contact us!