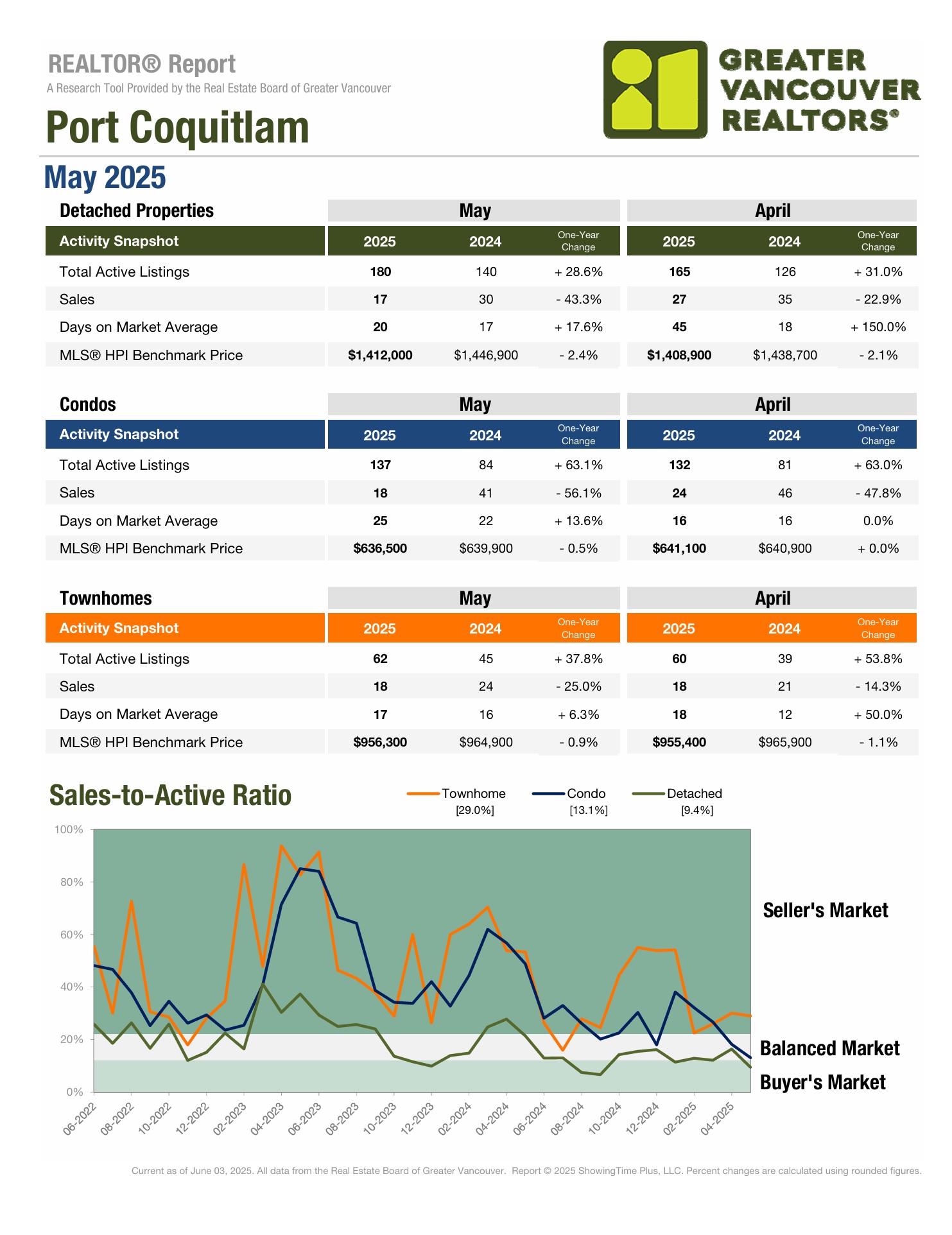

Port Coquitlam Market:

May 2025 vs 2024

A slow, CAUTIOUS, but steady market.

Listings continue to increase & sales dip year-over-year...as buyers continue their hunt for the perfect home

Looking for an accurate picture of where the real estate market is headed?

Today we dive in and take a deeper look at the Port Coquitlam market as a whole:

- A full overview & an in depth look at detached homes and townhouses. Both focusing on:

- How statistics stack up to the previous month's activity.

- Where we are standing compared to the same time period in 2024.

- Larger market trends.

•••

Port Coquitlam Benchmark Price Overview:

- Townhouse: Of all three areas of the market townhomes have now been leading the way for seven months straight. Their sales are holding despite the benchmark price increasing over $73,000 and a large swath of supply.

- Detached: Since plunging downwards last November the detached market has a yo-yo pattern; the benchmark price has dropped and increased in a fairly reliable pattern…never regaining the October 2024 high. In May, after two down months, we saw a small increase. If the pattern holds June will also be marked by an increase.

- Condo: In February 2025 the condo benchmark price dipped below its 2024 counterpart. Since then, condos have been within the same 1% of price as they were the previous year...and May was no different. The condo market could be viewed as stagnant, or reliable and consistent; while it a purchaser may not expect a large return on investment...they are less likely to lose money than other segments of the market. For over a year the benchmark price has fluctuated within a $20,000 window.

Port Coquitlam Market Snapshot (a review):

- Over the last six months the real estate market in Poco has developed as follows:

- The year finished continually decreasing supply, a holiday sales slump, & increasing prices for attached homes.

- After two months of steep decline detached homes started 2025 with a price increase, condo sales shot up, & days on market took a large spike upwards.

- February saw a big jump in townhouse pricing, supply still well below Oct/Nov 2024 levels, large days on market decrease, & relatively low-but steady-sales.

- The main change in March was supply, it increased across the board. Month-over-month sales saw a small increase...year over year sales are 26-36% down.

- In April supply continued to rise, sales volume remained low, and 2/3 of the market held pricing whie detached homes dipped for the second consecutive month.

- After two months of minor pricing decreases May brought an increase to the detached market and condo dipped. Supply remains high, but the rate of increase has decreased. Number of sales dipped for both detached homes and condos while it held for townhouses.

Year-over-year Comparison:

- Last November the detached market took a big step backwards, and since then it has been in recovery mode. 2025 has been marked by incremental changes in both directions. For every gain there has been a loss. The benchmark price sits $10,900 above where it did in January.

- The last two rounds (March & April) of pricing decreases came at the exact time 2024 was seeing an increase. Although May did see a slight increase, it was minor, and the benchmark price has still dipped $34,900 below the May 2024 benchmark.

- The last time detached homes dipped below the previous year's benchmark was June 2023.

- How the townhouse market has evolved since dipping under $900,000 in October 2024:

- November & December both saw improvement, but January 2025 was a large step backwards.

- January was the only stumbling blog in the last 7 months.

- After jumping up in February, March-May all saw the benchmark price inch upwards.

- The benchmark price is now the highest is has been in a year. It was at $964,900 in May 2024.

- Currently $8,600 below the 2024 peak of last May.

- After peaking in February 2024 the condo market has really levelled off.

- Feb 2024 the benchmark price was $650,200.

- Since then, lowest the benchmark price has fallen is $23,200 (November 2024)

- As of May, 2025 the benchmark is just $13,700 below the 2024 peak.

- For 15 months now pricing has continued to ebb and flow depending on the style of unit available and the number of buyers in the market. It remains the steadiest pillar in the market. Not surpassing the 2024 peak...but also not falling far from the high.

- May was the first time the 2025 broke from the alternating pattern in benchmark increases/decrease.

- The 2025 high was in January when the benchmark price sat at $645,400. It has fluctuated in a $9,900 window over the past 5 months.

Overall Supply & Sales Update:

Compared to the same time last year supply remains high:

- Detached: +28.6%

- Condo: +63.1%

- Townhouse: +37.8%

When May supply is compared to April:

- Detached: 15 more listings than in April

- Condo: 5 more listings than in April

- Townhouse: 2 more listings than in April

Compared to the same time last year sales have decreased:

- Detached: -43.3%

- Condo: -56.1%

- Townhomes: -25%

Sales decreased/held month over month (compared to April):

- Detached: 7 less sales than April

- Condo: 6 less sales than April

- Townhouse: same amount of sales as April

•••

Detached Market Update:

- May 2025 vs 2024 sees the detached benchmark price decrease by $34,900.

- The first three months of 2025 were stronger than the last three months of 2024.

- After two months of benchmark decline, totalling $11,600, May saw a slight increase.

- Overall 2025 has been stable fluctuating within a $19,000 window.

- The real damage to the detached market was done during the last two months of 2024 which saw the benchmark price drop $77,400 in just 60 days. Percieved issues with the first five months of 2025 are mostly a result of the market not rebounding as quickly as it normally has.

- Pricing peak:

- We are now $44,000 below the 2024 peak.

- & just $8,500 below the 2025 peak.

Detached Home Benchmark Pricing:

- June: $1,423,900

- July: $1,436,900

- August: $1,432,100

- September: $1,419,100

- October: $1,456,900

- November: $1,392,700

- December: $1,379,500

- January 2025: $1,401,100

- February: $1,420,500

- March: $1,418,500

- April: $1,408,900

- May: $1,412,000

•••

Townhouse Market Update:

- October 2024 was the low point for the townhouse market. The benchmark price had dropped $69,800 in just 60 days.

- The benchmark price rebounded quickly before dipping in January.

- Four the last four months the townhouse market has been rock solid with the benchmark fluctuating less than $6000.

- Althought townhouses are still JUST below the 2024 peak of last April they are now at the highest benchmark price of the last 12 months.

- The benchmark price has climbed $73,400 since October 2024.

- Despite this segments strength five of the last eight months have seen the benchmark price below the previous year.

- It is now 0.9% below May 2024.

Townhouse Benchmark Pricing:

- June: $950,600

- July: $943,200

- August:$952,700

- September: $900,200

- October: $882,900

- November: $936,600

- December:$940,700

- January: $924,200

- February: $950,000

- March: $950,700

- April: $955,400

- May: $956,300

Summary:

Port Coquitlam’s real estate market in May 2025 is defined by rising inventory, cautious buyers, and steady—if subdued—momentum. Compared to last year, sales have declined across all segments while listings continue to grow, especially for condos and detached homes. Buyers are active but selective, and pricing trends reflect a market slowly regaining balance after volatility in late 2024.

Despite world events, and catchy headlines the Port Coquitlam market has proven to be more steady in 2025 than it was for much of 2024.

Detached homes saw a slight price uptick in May following two months of minor decline, keeping 2025 benchmark values within a narrow range; over 5 months the benchmark has only fluctuated 19k. The main issue with detached homes is a slow recovery after a dismal end to 2024.

Townhouses have been rock-solid for the last four months. This segment has now fully recovered from the $69,800 decline starting September 2024 and benchmark prices are the highest they have been in the last 12 months.

Condos remain the steadiest segment. While not showing major gains, prices have fluctuated within a tight $10,000 range this year. Down only $13,700 from their 2024 peak, condos offer low volatility.

Overall, Port Coquitlam’s market is cautious but not stagnant, there are pockets of opportunity.

Our Google reviews will give you all the confidence you need!

TOP 5 reasons to work with R3 Hayes Real Estate Group

In a market full of noise and hesitation, we’re the steady hand you can trust.

Whether you're planning ahead or ready to make a move, let's talk strategy—we’re here to help you come out ahead.

R3 Hayes Real Estate Group – Your Neighbourhood Experts

Call/Text Ryan: 604-561-2127

Follow us on social media for more market updates!