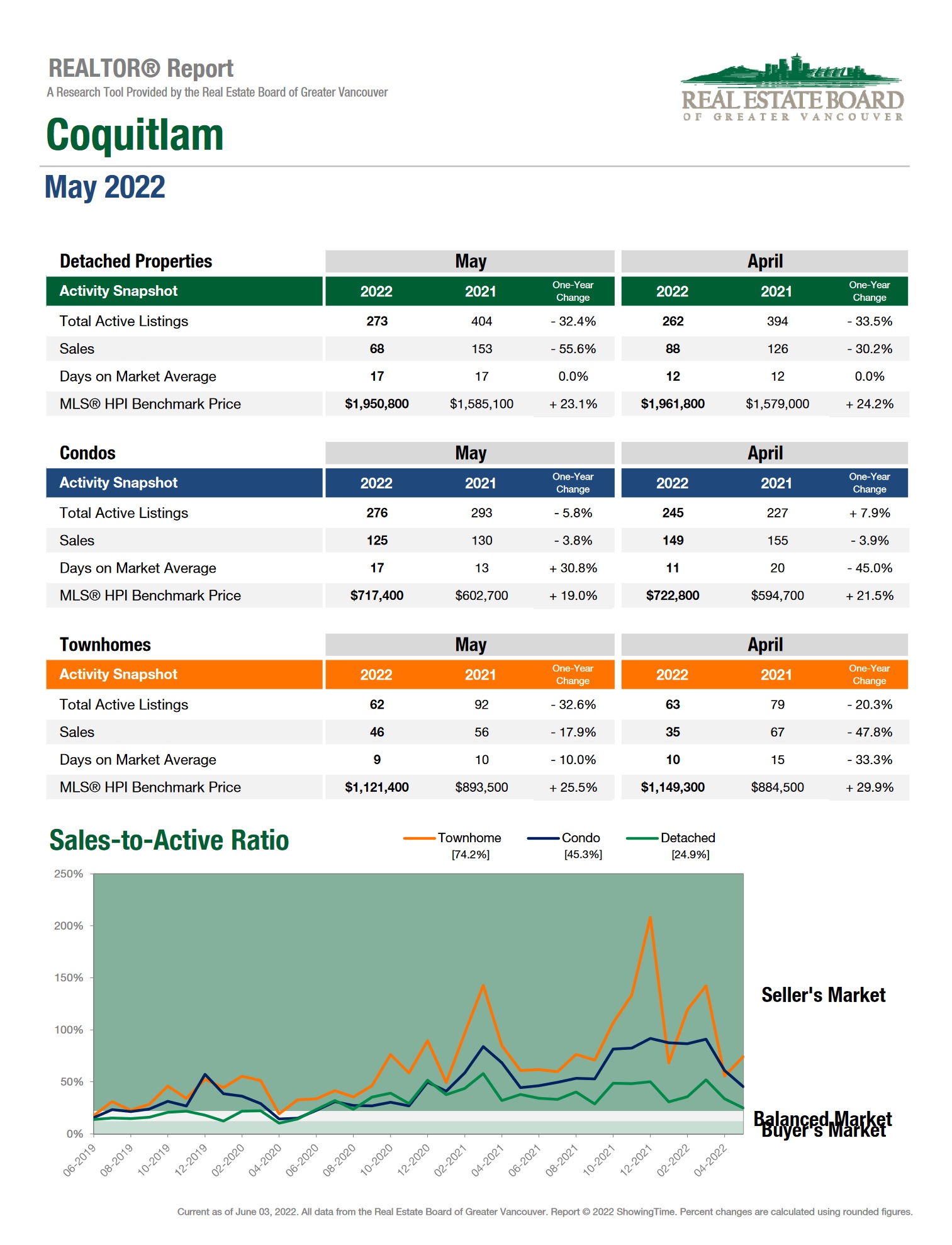

Benchmark prices are up across the board, between 19%-25.5% over thier 2021 counterparts.

The May benchmark for detached homes was $365,700 higher than its 2021 counterpart.

Detached Market:

This month there was a major change to how the Home Pricing Index (HPI) is calculated

in an attempt to make it a more accurate reflection of the market for the average buyer/seller.

The new HPI has had a substantial affect on the benchmark pricing of detached homes.

According to the old model April's benchmark price was $1,847,800.

The new HPI formula has recalculated April's benchmark at $1,961,800

That is an increase of $114,000 to April 2022's benchmark price.

May marks the first time in just over two years that detached home's benchmark pricing has dropped.

It decreased $11,000 in the last 30-days.

April: $1,847,800 (old HPI)

April: $1,961,800 (new HPI)

May: $1,950,800

Supply:

Compared to the same time last year supply was down across the board between 5.8%-32.6%

However, compared to April 2022 supply has generally increased.

Sales:

Sales decrease across the board, compared to both April 2022 and May 2021

The market is showing signs that it has entered a holding pattern in anticipation of a transition.

Compared to the same time last year sales are down between 3.8-55.6%

Townhouse Market:

Just like detached home's the new HPI has had a substantial affect on the benchmark pricing of townhouses.

According to the old model April's benchmark price was $1,064,000.

The new HPI formula has recalculated April's benchmark at $1,149,300

That is an increase of $85,300 to April 2022's benchmark price.

April: $1,064,000 (old HPI)

April: $1,149,300 (new HPI)

May: $1,121,400

May saw the first decrease in benchmark pricing for townhouse's in 21 month.

Townhouse benchmark pricing is $227,900 higher than the same time in 2021.

SNAPSHOT:

Decreasing sales. Decreasing Prices. Steady Supply. A market in transition.