As demand returns to local markets the big question is now becoming...where is the supply?

Looking back at a busier than expected four months Royal LePage has highlighted 2023's market achievements so far, while adjusting their expectations for the remainder of the year.

Looking back at a busier than expected Q1 Royal LePage has isolated five key retrospective highlights:

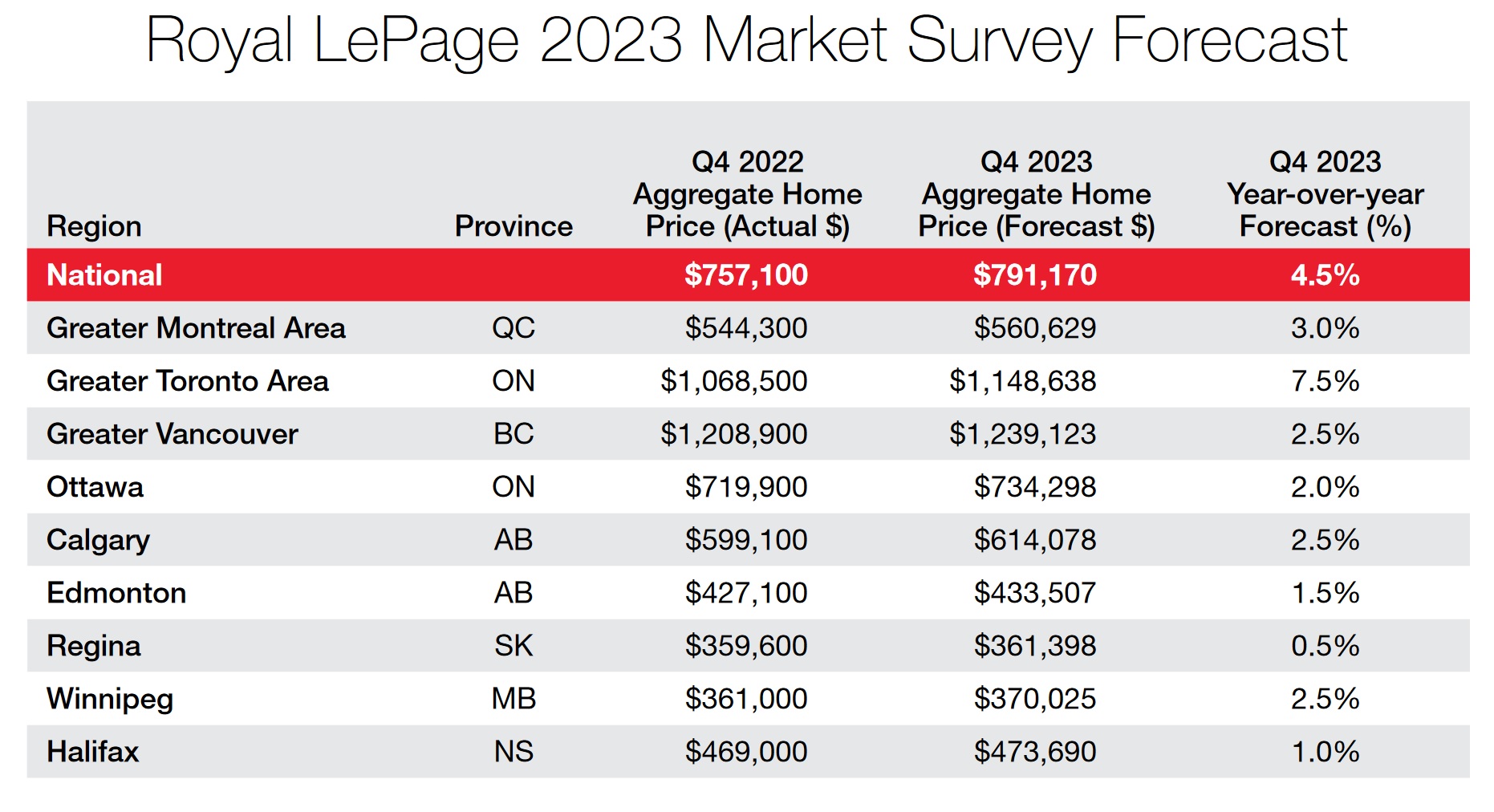

- National aggregate home price forecast to increase 4.5% year-over-year in Q4 2023

- Single-digit price gains in first quarter driven by early return of sidelined buyer demand and continued shortage of inventory

- National aggregate home price up 2.8% quarter-over-quarter in Q1 2023; down 9.2% over same period in 2022

- Greater regions of Toronto, Montreal and Vancouver post quarterly aggregate price gains of 4.8%, 1.3% and 1.3%, respectively in the first quarter

- Royal LePage urges OSFI to heed the economic dangers that would accompany new, aggressive mortgage restrictions

Addressing Greater Vancouver specifically Royal LePage's report had the following to say:

"The aggregate price of a home in Greater Vancouver decreased 10.6 per cent year-over-year to $1,224,200 in the first quarter of 2023. On a quarterly basis, however, the aggregate price of a home in the region increased 1.3 per cent.

Broken out by housing type, the median price of a single-family detached home decreased 11.2 per cent year-over-year to $1,661,400 in the first quarter of 2023, while the median price of a condominium decreased 9.9 per cent to $746,300 during the same period."

Randy Ryalls, managing broker at Royal LePage Sterling, added the following:

There is no shortage of buyers in Greater Vancouver these days. After waiting for home prices to hit a floor, buyer hopefuls have returned to the market ready to compete, a mindset that is fueling multiple-bid scenarios and zero-condition offers once again, in some cases,” said Randy Ryalls, general manager, Royal LePage Sterling Realty. “Our market continues to face extremely low levels of inventory, an issue that is sustaining competition among purchasers. As move-up buyers have little product to choose from, they continue to hold off on listing their homes for sale. This hesitation is hindering inventory turnover.

The price correction we experienced over the past year is now behind us. I expect we’ll see a modest uptick in prices in 2023 as demand continues to outpace supply,” said Ryalls. “While we hope to see a boost in home inventory over the spring months, it is unlikely to be enough to feed the continuously rising demand we’re experiencing.

Thinking broadly, from a Canada wide perspective, Royal LePage has amended their Q2-Q4 forecast:

Royal LePage is forecasting that the aggregate price of a home in Canada will increase 4.5 per cent in the fourth quarter of 2023, compared to the same quarter last year. The previous forecast has been revised upward to reflect an earlier-than-expected boost in activity in Canada’s major housing markets.

Addressing the past year directly Phil Soper, President & CEO of Royal Lepage had the following to say:

“Coming out of a correction, it is common to underestimate the speed at which the market will turn itself around. As market activity is rebounding quicker than anticipated, we are looking ahead with a sense of cautious optimism,” noted Soper. “While we do not expect huge price gains this year, some sense of normalcy is returning to the market."

Click here for Royal LePage's full national maret review, region breakdown, forecast, & policy outline.

If you have more questions...we have answers!

Your Neighbourhood Experts

CLICK HERE to contact us