Tri City Attached Home Review Comparison:

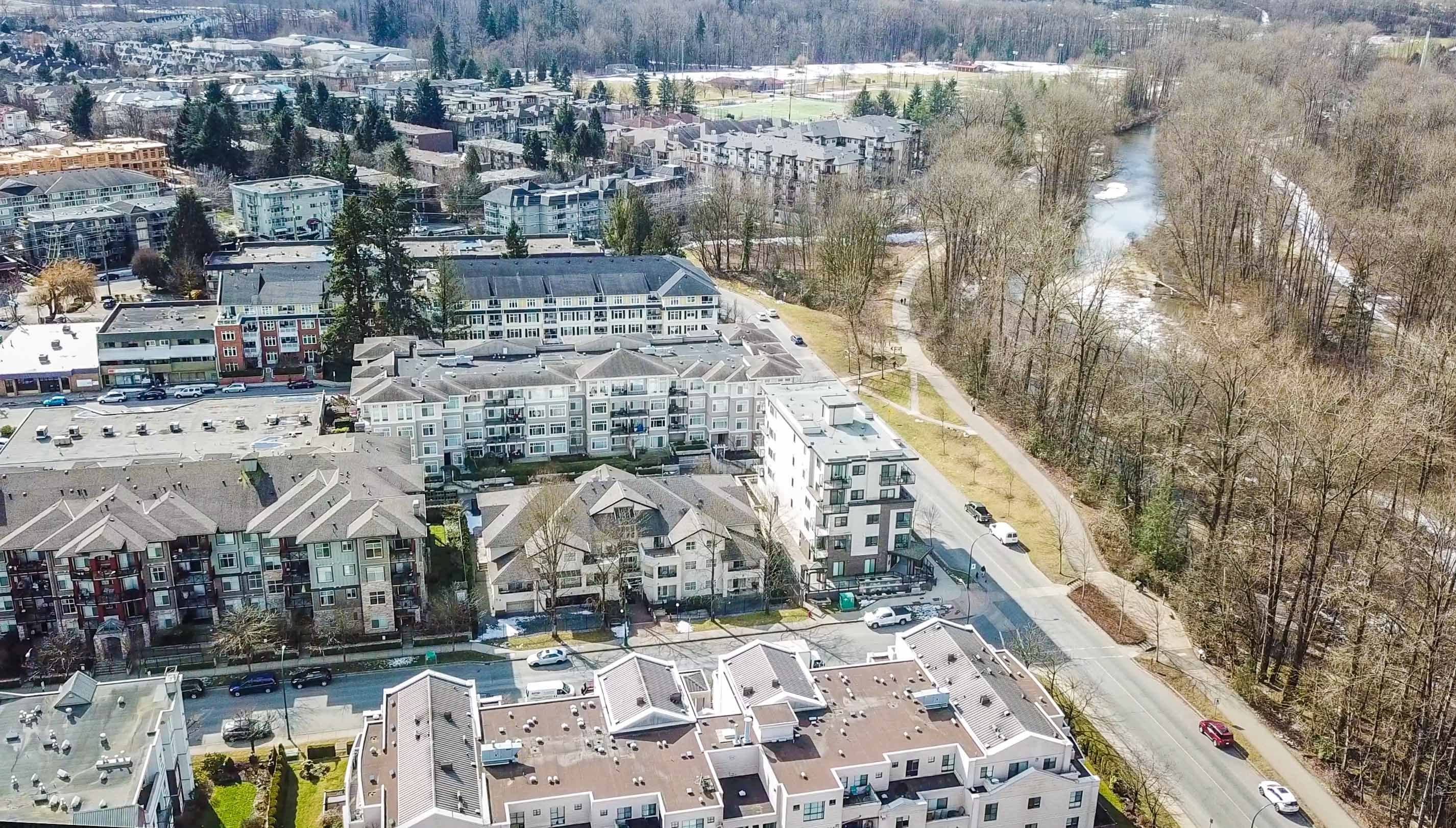

The Tri Cities are an informal grouping of the three adjacent cities of Coquitlam, Port Coquitlam, and Port Moody. The Tri Cities also includes the two villages of Anmore and Belcarra. The entire area is located in the northeast sector of Metro Vancouver, and combined, these five communities have a population of roughly 234,000 residents. With vibrant culture, abundant natural beauty, a central location, and a drive to continually evolve and elevate...it is a fantastic place to look for a home.

- All statistics below were gathered on April 16th and compared with February 10th meaning the findings represent the markets overall shift in the last 65 days.

Click Here for February 10th attached statistics comparison to November 6th 2024

•••

Number of attached listings;

- Port Coquitlam: 179 (up 72)

- Coquitlam: 743 (up 158)

- Port Moody: 177 (up 71)

- For the majority of 2024 supply was at an all time high throughout Greater Vancouver. After buyers returned to the market in October supply took a dip to finish off the year…but only a slight one.

- Six weeks in to 2025, as of our last check in, supply has dropped as January started off with an active buyer base.

- Since then, supply has skyrocketed and buyers, while still active, have withdrawn. A very tenuous balance remains…but the market is leaning towards buyers due to high supply.

•••

List Price:

Port Coquitlam:

- High - $1,700,000 (3000 sqft, 7yr old townhouse)

- Low - $389,800

- Average -$760,387 (up $34,613) --still not up to Nov 2024 levels

- Median - $699,800 (up $50,800)--parity with Nov 2024

Coquitlam:

- High - $2,200,000 (1/2 duplex)

- Low - $384,900

- Average -$867,438 (down $28,528)

- Median - $795,000 (down $14,900)

Port Moody:

- High - $2,299,800 (3bed penthouse)

- Low - $448,000

- Average -$918,686 (down $21,318)

- Median - $869,900 (same)

- 2024 was filled with a prolonged (April – September) mild softening period. And ended with a section of relative stability. Prices didn’t fluctuate wildly in 2024.

- The first two months of 2025 continued on much of the same trajectory as the final three of 2024. Minor fluctuations with relative stability for 2/3 of the Tri City area.

- Port Coquitlam was our outlier in the February update with a large spike downwards due to the large number of 1 bed/studio offers on the market. This time it is the outlier as the only city to see a pricing increase. However, there are now over 120 2-bed+ units for sale. This supply shift drove up the median making it seem like Poco experience a large pricing increase.

- Although buyers have retracted since our last update prices in both Port Moody and Coquitlam remain steady. ‘Sharp’ priced homes are selling which is having a minor effect on median prices.

•••

Days on Market:

Port Coquitlam:

- High - 304

- Low - 0

- Average - 34 (down 7)

- Median - 21 (same)

Coquitlam:

- High - 1370

- Low - 0

- Average - 52 (down 5)

- Median - 35 (up 7)

Port Moody:

- High - 303

- Low - 0

- Average - 37 (up 3)

- Median - 29 (up 9)

- 2024 was slow, homes were not flying off the market for the majority of the year. Finally, by October days on market stopped climbing upwards and the median took a minor dip.

- Our last update was just six weeks into 2025. We had just experienced an early start to the year and days on market had dipped. Nothing major, roughly 10 days on average, but a prevalent change in relation to the last 12 months.

- Now three and a half months into the year and not much has changed. Across the board there have been fluctuations, but none large enough or consistent enough to call a trend.

- With supply spiking the real question for our next update is will we see a large increase in days on market if buyers to surge back to meet supply.

•••

Overview:

After an active start to the year, the Tri-Cities attached market has entered a new phase—one shaped by rising supply, steady pricing, and cautious buyers.

In just 65 days, inventory has climbed sharply across the Tri Cities, tilting the market back toward buyers. While demand hasn’t vanished, it has softened—creating a tenuous balance that continues to favour those looking to purchase.

Price trends remain relatively flat. Days on market tell a similar story. There’s movement, but no momentum. Homes are still selling, especially if priced sharply, but there's no clear directional trend.

The big story with this update is the supply increase…and the big question is…will buyers return to the market to soak up all of the new listings, or will days on market rise potentially causing a pricing decrease? The next 4-6 will be crucial in deciding this.

•••

Are you looking to purchase a condo or townhouse in the Tri Cities? Let us know the particular area and style of home you are looking for and we will keep an eye on the market for you and let you know when your perfect home is listed.

Let our knowledge and expertise ease your mind, so you don't have to stress over the details. We are working to make your life easier.

TOP 5 reasons to work with R3 Hayes Real Estate Group!

Ready to make your real estate goals a reality? Reach out today...let’s get started!

R3 Hayes Real Estate Group – Your Neighbourhood Experts

Call/Text Ryan: 604-561-2127