Sales in 2023 to remain similar to 2022 activity

Generally speaking on the outlook of the 2023 market the REBGV had the following to say:

"Metro Vancouver home sales set or neared historic records in 2021 and 2022 on both ends of the spectrum. Sales activity hit a record high in March of 2021 and closed 2022 near historic lows after accounting for typical seasonal variation.

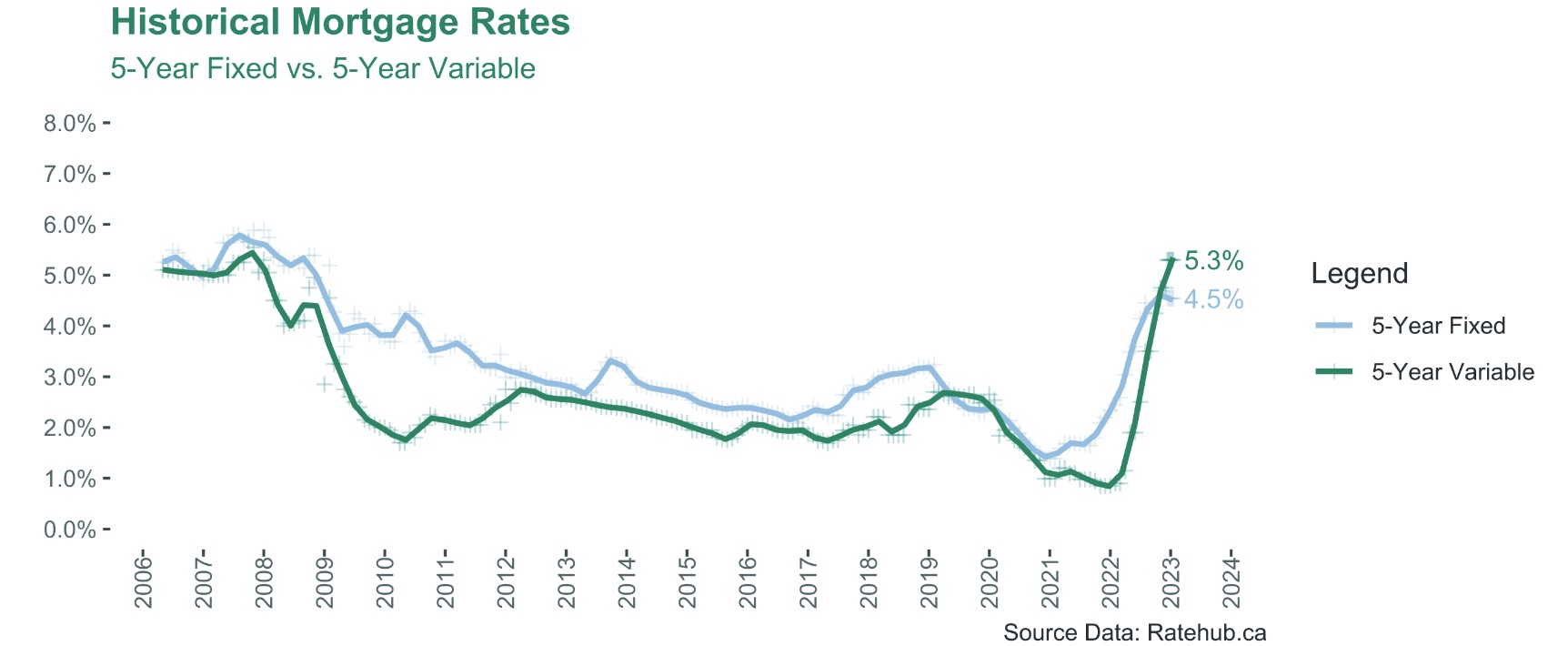

The key economic variable most responsible for this oscillation between extremes has been the spike in mortgage rates, as a result of the Bank of Canada rapidly raising the policy interest rate to quell inflationary pressures not seen in the country in more than thirty years.

At the time of publication, inflation remains stubbornly high, despite the Bank of Canada’s historically monumental efforts to bring inflation back to their preferred target range of between one and three percent. Largely because of this, mortgage rates are expected to remain higher than market participants had been used to in recent times.

Historically, the data indicate that when mortgage rates rise rapidly, sales activity in Metro Vancouver has tended to slow considerably and can take upwards of 24 months to recover to levels seen before the tightening cycle began."

Sales Forecast:

Overall sales in Metro Vancouver as froecast to drop 2.6% in 2023; from 29,261 in 2022 to roughly 28,500 in 2023. While apartments as set to see a potential 7% reduction in sales, detached homes could see as much as a 4.3% increase.

Pricing Forecast:

Delving in to Vancouver historical outlook the REBGV had the following to say:

“In percentage terms, rapidly escalating mortgage rates haven’t tended to impact prices as negatively inMetro Vancouver as they have sales activity, historically speaking.

It was only the tightening cycle of the early 1980s, which resulted in a fairly significant price correctionin the Metro Vancouver market. Nearly all other historical tightening cycles in Canada yielded more modestdeclines in prices in the region. Interestingly, a few tightening cycles were even associated with priceescalation; a somewhat counterintuitive result that is nonetheless a verifiable fact of the historical record.

So far, the current cycle has resulted in prices declining roughly 10% from the beginning of the cycle, withthe pace of decline beginning to show signs of slowing.

A key factor that has underpinned prices in the region over the last 40 years has been the steady populationincrease in Metro Vancouver and surrounding areas. Despite the well-publicized challenges of housingaffordability in this region, the amount of people who continue choosing to reside here represent animportant source of demand pressure that continues to push up against a supply of homes that remainsscarce, in relative terms.”

Breaking it down: 2023 in numbers…

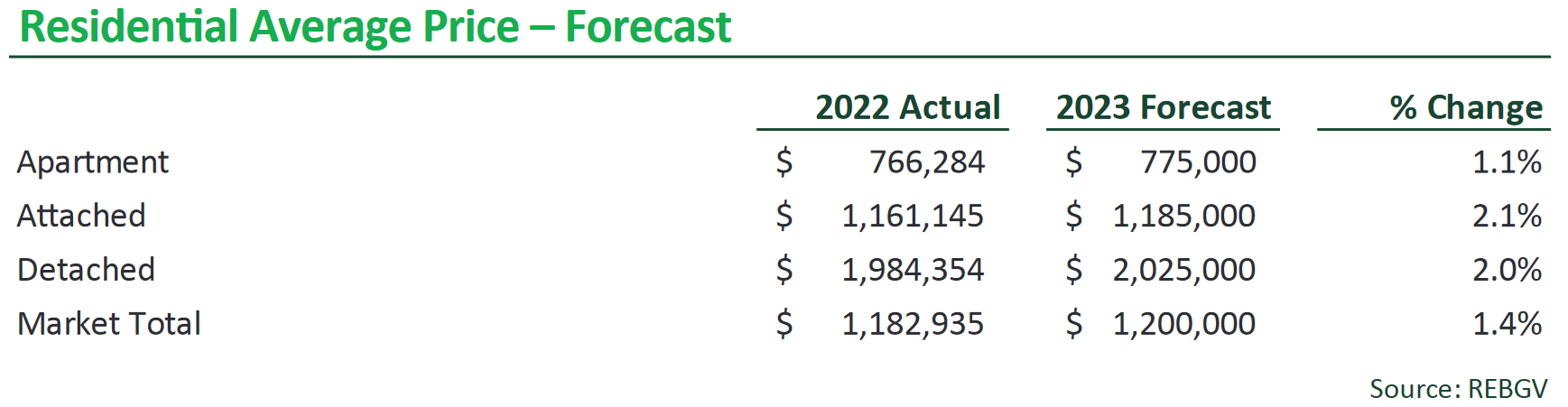

“The average price across all product types for the REBGV area is forecast to reach approximately $1.2 millionin 2023, which represents a 1.4 per cent increase over 2022. Prices for apartments, attached, and detachedhomes are projected to increase in price by approximately one to two per cent.”

Click here for the full Real Estate Board of Greater Vancouver Report

Do you have questions about how the market will unfold in your neighbourhood throughout 2023?

Click here to contact your Neighbourhood Experts!